Energy Savings Insurance

Energy savings insurance (ESI) is an innovative financial product that backstops shortfalls in actual energy savings from energy savings performance contracts (ESPCs). This kind of risk coverage can facilitate market uptake of these contracts as a means of deploying energy efficiency measures, especially among small and medium enterprises (SMEs). These entities typically have tight operating margins and often regard investment priorities other than efficiency upgrades as providing better risk-return tradeoffs. ESI can not only safeguard the savings stipulated in ESPCs, it can also improve the risk-return perception of energy efficiency investors like SMEs, thus facilitating larger flows of capital to the energy efficiency industry. Before discussing the details of the ESI policy, it is necessary to describe how the ESPC model works.

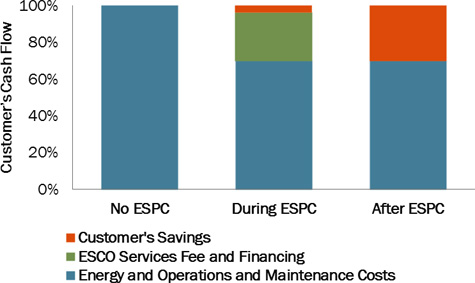

ESPCs are standardized contracts executed between property owners and energy “efficiency service providers” and allow property owners to finance the installation of energy efficiency measures. Typically, property owners will take out a bank loan to cover the cost of the energy efficiency upgrades, and will service this debt with savings on their energy bills. The level of these savings is stipulated in the ESPC. The following figure depicts how these contracts generally affect cash flow.

The ESPC model can be an effective means for property owners to reduce their energy costs, which can be a significant operating expense. However, there is a risk that the energy savings projected by the efficiency service providers —the installer of the energy efficiency equipment—may not achieve the levels stipulated in the contract. In such a case, the property owner would face higher energy-related bills, thus making it difficult for the energy efficiency project to generate the cash flows required to pay for its costs (depending on the contract and the outcomes of any disputes over the shortfalls in savings) (Mills 2003). (One way to ensure the incentives of the efficiency service provider are aligned with those of the property owner and that the equipment performs according to specifications is to make payment dependent on performance and withhold a portion (e.g., 20%–25%) of total project costs. Such a retention is gradually paid out as energy savings materialize).

Energy savings insurance mitigates the risks associated with a mismatch between guaranteed and actual energy savings in an ESPC. Efficiency service providers would take out an ESI policy when executing an ESPC, and the policy beneficiary (property owner) would receive payment for any shortfall in energy savings below a pre-agreed baseline and beyond the retention in the ESPC over the policy term. If the terms and price of the policy are calibrated to meet market needs, ESI could give property owners the protection and, importantly, the comfort they require to make significant energy efficiency investments.

Program Design

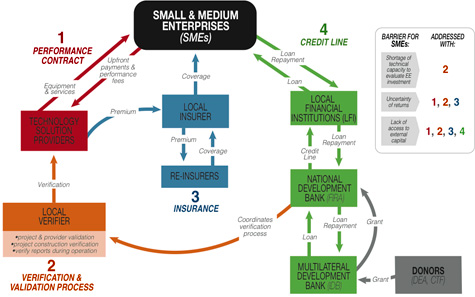

National governments and national development banks (NDBs) (collectively referred to here as “implementing entities”) have a critical convening role in promoting the uptake of ESI products by private insurance providers in the local market. These implementing entities can partner and execute agreements with a number of international and local entities to ensure that (1) an insurance program is well-designed and (2) property owners are duly aware of its existence and benefits. For example, this figure is a conceptualization of an Inter-American Development Bank (IDB) program implemented in Mexico and analyzed by the Global Innovation Lab for Climate Finance (Micale et al. 2015).

Click on the image for a full-size version.

Implementing entities can act as aggregators of the various actors in the value chains displayed in the figure. Responsibilities could include:

- Conducting market research to assess demand for energy efficiency among SMEs, as well as how the economics of an ESI product would play out in the particular market environment

- Assembling and executing partnerships or agreements with major international reinsurance companies as well as local insurers to bring the insurance products into the marketplace at adequate conditions

- Identifying efficiency service providers (“Technology Solution Providers” in the graphic above) with robust track records and strong balance sheets which may access the product and market themselves as insured

- Selecting a credible and prestigious entity in the local market to fulfill the requirements of third-party verification (see below)

- Working with multilateral and bilateral development finance institutions to funnel low-cost capital to local commercial banks, and creating programs for these commercial banks to offer low-cost credit to SMEs for investments in energy efficiency

- Developing capacitation and technical assistance programs supporting “evangelism” of energy efficiency programs among end users of energy, financial institutions and technology providers.

Partnering with NDBs and other implementing entities for energy savings programs enables the effective creation a pipeline of bankable projects. This is largely because NDBs typically have wide networks of local finance institutions through which to reach a broad range of potential SME end-clients. Furthermore, NDBs also ensure local ownership and alignment with national development priorities, and they deliver risk mitigation instruments beyond what the market offers (Smallridge et al 2012).

The IDB has structured ESI pilots for implementation in developing countries based on previous experience with energy efficiency projects (IDB et al. 2012; IDB 2015; Dufresne et al 2012, 2013; Biaou et al. 2012). The first two pilots are aimed at incentivizing private investment by SMEs in Colombia and Mexico. The pilots are have been implemented with funding from the Clean Technology Fund, with the Colombian NDB Bancoldex (Bancoldex 2015; CIF 2013a; IDB 2013, Pegels et al. 2015) and with the Mexican Trust Funds for Rural Development (FIRA), with additional support from the Danish Energy Agency (CIF 2013b; IDB 2014; D’Addario et al. 2014; FIRA 2015; Micale et al. 2015; EFMK 2015). In Colombia, the insurance company SURA is offering the ESI and has been endorsed for this innovation (Best’s Review 2015).

Standard Contracts

Standard contracts can reduce transaction costs, mitigate the potential for policy disputes and create trust among technology solution providers and end users. Furthermore, they allow for customer transparency in the underwriting and execution of the insurance policy. Any ESI program that is implemented through a national government or and NDB or other development finance institution should strive to standardize contracts for use by local insurers and their reinsurers.

Third-party Verification and Monitoring

To protect insurers and any public capital invested in an ESI program, national governments and NDB/DFIs should institute a robust third-party technical verification process not only for efficiency service providers but also for the projects that they structured on behalf of end-users. These technical verifications should ensure (1) the installation of a particular project for which ESI is sought is undertaken according to prevailing standards and (2) there is a reasonable expectation that it will function as designed. Faulty workmanship on energy efficiency installations or inappropriate energy efficiency equipment can lead to avoidable shortfalls in energy savings for the property owner, and this will trigger unnecessary policy payouts. Such payouts could ultimately raise premiums for ESI customers and could make the cost of such a policy too great to be feasible for the smaller efficiency service providers, which may require it the most. Ongoing third-party monitoring should also be required, as this will ensure the equipment is properly maintained and serviced when necessary. Additionally, this approach promotes the use of standard monitoring, reporting and verification protocols that simplify the structuring of energy efficiency projects.

Pairing with Other Incentives

An ESI product may not be enough for a SME to invest in energy efficiency upgrades beyond simple lighting replacements or other low-investment options. Accordingly, national governments and DFIs might consider implementing an ESI program in conjunction with other incentives, such as low-cost credit lines, success fees, grants, tax incentives or other mechanisms. A well-designed holistic ESI policy that mitigates potential energy savings shortfall risks for property owners should play a major role in stimulating increased energy efficiency investments by SMEs.

See Also

Bancoldex. 2015. “Línea de crédito Bancoldex eficiencia energética para hoteles, clínicas y hospitales.” Bogotá, Colombia: Bancoldex. Accessed November 2015, https://www.bancoldex.com/contenido/contenido.aspx?catID=403&conID=7867.

Best’s Review. 2015. Going Green in Colombia – An insurer and a team of banks develop energy-efficient solutions initially targeted to hotels and hospitals. Oldwick, NJ: Best’s Review.

Biaou, L., P. Langlois, and J. Chabchoub. 2012. Guía B: Justificación de la intervención del gobierno en el mercado de eficiencia energética. Washington, D.C.: Banco Interamericano de Desarrollo. Accessed October 2015, http://publications.iadb.org/handle/11319/3735.

Buonicore, A. 2011. “Energy Savings Insurance and the New ASTM BEPA Standard.” Green Building and Sustainable Development in the Commercial Real Estate Industry: Critical Issues Series. Paper No. 11 -003. Naperville, IL: BEPANews. Accessed September 2015, http://srmnetwork.com/wp-content/uploads/Whitepaper_ESI_BEPA_11-15-11.pdf.

Climate Investment Funds (CIF). 2013a. IDB-CTF Energy Efficiency Financing Program for the Services Sector. Washington, D.C.: CIF. Accessed November 2015, https://www-cif.climateinvestmentfunds.org/sites/default/files/Approval_by_Mail_Colombia_Energy_Efficiency_Financing_Program_for_the_Services_Sector_(IDB)_Project_Document.PDF.

CIF. 2013b. Amendment to the Mexico CTF Investment Plan and to the Mexico Private Sector Energy Efficiency Program. Washington, D.C.: CIF. Accessed September 2015, https://www-cif.climateinvestmentfunds.org/sites/default/files/meeting-documents/amendment_to_the_mexico_ctf_ip_august_2013.pdf.

D’Addario, P., M. de Diego Olmeda, and A. Padilla. 2014. Energy Savings Insurance: A Design. Copenhagen, Denmark: Energistyrelsen. Accessed September 2015, http://www.ens.dk/sites/ens.dk/files/energistyrelsen/Nyheder/design_of_an_energy_savings_insurance_instrument_-_final_2.pdf.

Dufresne, V., P. Langlois, M. Couture-Roy, S. Flamand, and S. Nour. 2012. Guía A: Programas de financiamiento de eficiencia energética: Conceptos básicos. Washington, D.C.: Banco Interamericano de Desarrollo. Accessed July 2015, http://publications.iadb.org/handle/11319/3725.

Dufresne, V., P. Langlois, M. Couture-Roy, and S. Flamand. 2013. Guía C: Diseño de programas de eficiencia energética. Washington, D.C.: Banco Interamericano de Desarrollo. Accessed August 2015, https://publications.iadb.org/bitstream/handle/11319/4809/GUIA_C_Simp.pdf.

Danish Ministry of Energy, Utilities, and Climate (EFMK). 2015. “Denmark’s Engagement in Energy Efficiency.” Copenhagen, Denmark: EFMK. Accessed November 2015, http://um.dk/en/~/media/UM/English-site/Documents/Politics-and-diplomacy/Onepager_k5_2.pdf.

Los Fideicomisos Instituidos en Relación con la Agricultura (FIRA). 2015. “Programa de Eficiencia Energética de FIRA.” Morelia, Mexico: FIRA. Accessed November 2015, http://www.fira.gob.mx/Nd/Eficiencia.jsp.

The Global Innovation Lab For Climate Finance. 2015. “Energy Savings Insurance.” Venice, Italy: The Lab. Accessed November 2015, http://climatefinancelab.org/idea/insurance-for-energy-savings/.

Inter-American Development Bank (IDB). 2013. Loan Proposal CO-L1124: CTF Energy Efficiency Financing Program for the Services Sector in Colombia and Technical Cooperation for Mitigation of GHG Emissions through Energy Efficient Investments in Hotels and Clinics/Hospitals Sub-sectors. Washington, D.C.: IDB. Accessed October 2015.

IDB. 2014. “ME-L1145: First Program for the Financing of Investment and Productive Reconversion Project in Mexico.” Washington, D.C.: IDB. Accessed September 2015, http://www.iadb.org/en/projects/project-description-title,1303.html.

IDB. 2015. “Energy Savings Insurance (ESI): An Innovative Solution.” Washington, D.C.: IDB. Accessed November 2015, http://www.iadb.org/en/sector/financial-markets/financial-innovation-lab/energy-savings-insurance-esi-an-innovative-solution,19717.html.

IDB, NAFIN, and KfW. 2012. Financial Instruments to Promote Energy Efficiency: The experience from Local Financial Institutions in Latin America and the Caribbean.

Miller, A., and Laird, M. 2015. “Financial Instruments & Innovative Risk Mitigation Instruments for Climate Financing.” Presentation delivered at LEDS GP Annual Conference. Golden, CO: LEDS GP. Accessed November 2015, http://ledsgp.org/wp-content/uploads/2015/10/Session-3-Financial-Instruments-and-innovative-risk-mitigation-instrument.pdf.

Mills, E. 2003. “Risk Transfer via Energy Savings Insurance.” Energy Policy 31: 273–281. Accessed June 2015, http://evanmills.lbl.gov/pubs/pdf/energy_savings_insurance.pdf.

Pegels, A., Figueroa, A., and Never, B. 2015. The Human Factor in Energy Efficiency: Lessons from Developing Countries. Bonn, Germany: Deutsches Institut für Entwicklungspolitik. Accessed November 2015, https://www.die-gdi.de/uploads/media/The_Human_Factor_in_Energy_Efficiency_FINAL_LOW_RES.pdf.

Smallridge, D., Buchner, B., Trabacchi, C., Netto, M., Gomes Lorenzo, J.J., and Serra, L. 2012. The Role of National Development Banks in Intermediating International Climate Finance to Scale Up Private Sector Investments. Washington, D.C.: IDB. Accessed July 2015, http://publications.iadb.org/handle/11319/5692.